By Leo John

The pandemic has forced healthcare providers to change the way they operate. One of the most significant changes has been handling medical billing services and health insurance reimbursement. With so many patients unable to pay their bills, providers are looking for ways to boost medical reimbursement benefits and minimize bad debt.

One way to do this is through effective RCM (Revenue Cycle Management) strategies. RCM manages healthcare’s financial aspects, from patient appointment scheduling to insurance claims processing. By implementing effective Revenue Cycle Management in medical billing services, healthcare providers can boost medical reimbursement benefits, improve patient satisfaction, and reduce cost.

This article will explore some of the most effective RCM strategies that healthcare providers can use to boost reimbursement and improve their bottom line.

What is Medical Billing?

The medical billing service consists of a series of steps to ensure that medical professionals and healthcare centers are reimbursed for their services. The reimbursement process may take days to months, depending on the circumstances. Revenue Cycle Management Process may vary a little between healthcare providers , but the process is the same.

The Medical Billing Services Follow the Given Cycle:

- Patient Registration

- Financial Responsibility

- Bill Creation

- Claim Generation

- Claim Submission

- Claim Adjudication Monitoring

- Statement Preparation

- Follow-up – Bills paid

Medical billing services and medical coding are essential components of healthcare’s revenue cycle, ensuring patient and insurer reimbursement. The process of medical coding involves extracting billable information from medical records and documents. The codes generated by Medical Billing Services are used to create health insurance reimbursements or claims and bills for patients. Medical billing and coding intersect at the point of creating claims and form the backbone of the revenue cycle.

Revenue Cycle Management in medical billing is defined as all administrative and clinical functions that contribute to capturing, managing and collecting patient service revenue.

RCM is the financial process related to a patient’s clinical encounter. According to the Healthcare Financial Management Association (HFMA), a fundamental role of RCM is to measure how well a healthcare organization maximizes the amount of patient revenue billed and how quickly it collects that revenue and what is the percentage of medical reimbursement benefit for the healthcare provider. While RCM primarily focuses on processing claims, payment, and revenue generation, it also includes patient services since care management directly impacts medical reimbursement benefits. With decreasing reimbursements and as more patients pay increasingly higher deductibles, it is important to have an effective revenue cycle management in medical billing to increase health insurance reimbursements.

Ensuring healthcare organizations understand the fundamentals of medical billing and coding can help providers and other Staff operate a smooth revenue cycle and recoup medical reimbursement benefit for quality care delivery.

Revenue Cycle starts with patient registration and ends when the insurance service or the patient himself pays for all the services rendered. The entire process may take days to months for completion, depending on the nature and complexity of the delivered services.

Healthcare providers or individual practitioners will get revenue only when the claims submitted are processed and reimbursed in less than 30 days. Accounts Receivables (A/R) more than 30 days leads to a decrease in revenue, and A/R after 120 days leads to a loss of revenue.

Medical Practices must ensure that the claims submitted by the medical billing department are accurate and pass the entire system within a few days with minimum or no error.

Payment delays and claim denials can occur even with small errors. Avoiding common medical billing and coding mistakes will help reduce the error rate and keep the patients happy.

In today’s economic environment, administrators and revenue cycle managers must implement best practices to effectively manage the revenue cycle to optimize efficiency and increase reimbursement.

What are the Most Common Medical Billing and Medical Coding Errors?

The most common errors in medical billing and coding are incorrect coding, missing information, and errors in patient information.

In recent years, there has been an increase in reports of incorrect coding in RCM systems. This problem can lead to several serious consequences, including inaccurate billing, incorrect payment, and fraud. The root cause of this problem is often found in how RCM systems are designed and implemented. In many cases, the systems are not designed to handle the complexities of real-world coding. As a result, they often generate inaccurate codes that can lead to problems down the line. There are several ways to solve this problem, but working with a team of experienced coding experts is the most effective solution. By working with a team that understands the nuances of RCM coding, you can be sure that your system will be correctly coded and that your billing will be accurate.

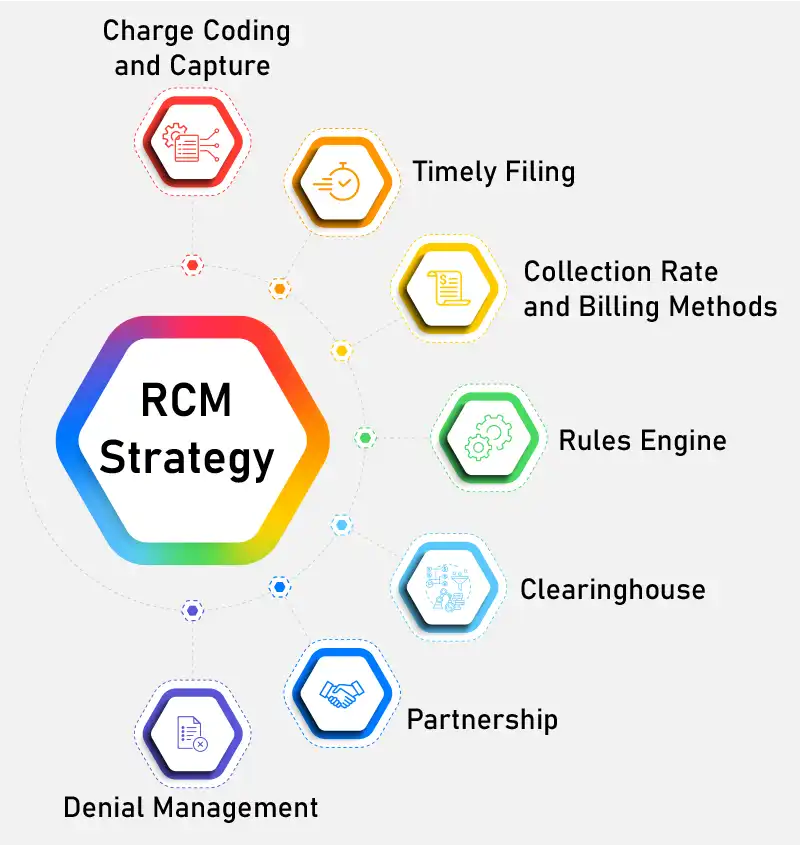

Functions for Effective Implementation of the RCM strategy:

Charge Coding and Capture

To improve the capture of charges, Staff should communicate suspense time to departments and include it as part of their policy and procedure. Suspense time frames are strict deadlines that require clinical departments to record fully audited, compliant and accurate charges for services provided. It is crucial to remember that every day that charges are not recorded and are subsequently withdrawn from suspense will negatively impact your day-to-day accounts receivable outstanding, as in cash flow. A regular review of the charge master is necessary to ensure that hospitals are collecting every penny correctly and they aren’t leaving money to be wasted.

Timely Filing

Many healthcare providers fail to file initial claims or respond to a claims appeal promptly due to inefficient or unmonitored processes, resulting in missed filing deadlines for either the initial filing deadline or the appeal’s timely filing deadline. Medicare allows the initial claims to be submitted within one year of the date of service, but many commercial payers now require claims to be submitted within 90 days. Medicare allows only 120 days to respond and appeal a claim denial. In comparison, many commercial payers may require anywhere from 90 days up to one year based upon your specific state and payer guidelines. Therefore, it is important to have processes in place to submit medical reimbursement benefit claims promptly and continually monitor claims on hold to ensure timely filing deadlines are not missed.

Collection Rate and Billing Methods

Based on the billing method, companies should anticipate receiving payments within as little as fifteen days (government payment methods). If insurance payments have an average of more than 30 calendar days between when claims are made, and the payment is received, the business’s office must create a procedure to follow up on claims. A formal method of the following regard to the state of the claim has proven to reduce the amount of time that health insurance reimbursement claims are not paid.

It is expected that the biller knows what each payer will allow and refuses to accept their client’s claims. Rejections are caused when there is an error in the claim and the claim is returned immediately by the payers without entry into their process system. Billers should process these health insurance reimbursement claims with the best practice and focus on the root of the rejection, to avoid the rejection from happening the next time. By doing this, they can improve the effectiveness of the health insurance reimbursement process of generating revenue via a decrease in the number of claims denied.

Rules Engine

With the adoption of EMRs (Electronic Medical Records), the amount of bad electronic billing data generated daily has skyrocketed. Physicians and other healthcare professionals did not go to medical school to become coders, yet they are responsible for managing the information. While manual processes are time-consuming and error-prone, rules-based software solutions are an efficient and reliable alternative to the health insurance reimbursement issues. Revenue cycle management software can eliminate costly, inefficient processes, automate tasks requiring human expertise, and streamline operations with proven ROI (return on investment).

A well-designed rules engine helps improve the chances of receiving payment on the first pass of a claim. Collecting data from healthcare providers through the network of other medical billing services, the software learns which claims are denied and why. The information can be used to avoid similar denials in the future. In addition, by catching potential denials before they’re submitted, practices are more likely to receive payment and health insurance reimbursement benefit on the first attempt. First-pass resolution rates for medical claims can increase to over 90%. This rate can increase as rules are updated and refined.

Clearinghouse

Revenue cycle management in medical billing is a process that ensures that healthcare providers receive all the payments due. It includes both payments made by the health insurance payers and those that patients pay. Many estimates indicate that medical practices collect as little as 60 percent of accounts receivable. Revenue cycle management in medical billing helps healthcare providers remove the entanglements from the reimbursement process to maximize their revenue stream and higher percentage of medical reimbursement benefits. A revenue cycle manager can help healthcare providers improve health insurance reimbursement efficiency and patient satisfaction.

Clearinghouses streamline the health insurance reimbursement process intending to reduce the number of denied claims in medical billing services. Instead of submitting claims to insurance companies directly, clearinghouses scrub and verify claims to ensure they meet eligibility criteria and receive full health insurance reimbursement. These clearinghouses help practices without a practice management system and reduce errors associated with medical billing services. These services are cost-effective and can save providers as much as $9.5 billion annually.

Partnership

To be successful in revenue cycle management, a physician must learn how to work with a revenue cycle management partner to achieve optimum revenue results. Traditionally, most physicians have performed the entire process internally, including medical billing services and medical reimbursement benefit collections. However, the COVID-19 pandemic has forced physician practices to make some changes. Besides, other factors also affect physician cash flow.

Denial Management

Monitoring, tracking and reporting on denials are vital components of a successful denials management strategy. Finding trends and the root cause of denials is crucial in developing an efficient RCM plan. Healthcare providers must monitor the reports and reduce the denials.

The Report Should Contain:

- Type of payer, reason, department

- Percentage of the revenue received

- Denials as a percentage of gross revenue

The best denial management practices will result in a reduction in the number of receivables (AR), a growth of cash, a rise in clean claim rate, a reduction in the volume of denials, and lower costs to collection rate.

Denial Management Strategies Should Include:

- Specified policies and procedures regarding identifying, tracking and reporting refusals, Analytics and reporting tools to keep track of denials as described in the previous paragraph.

- A multidisciplinary team of clinical and revenue cycle leaders with a stake in the processes impacted by denials.

- Meet regularly with the interdisciplinary team to discuss the latest trends in denial and formulate work plans to determine the reasons for improving the process.

- Training and education for Staff which focuses on standard procedures to reduce the risk of denials

- Management team reporting on denials, analytics, process improvement initiatives, and plans for education and training.

Common RCM Performance Key Indicators for Key Performance

Performance improvement, in practice especially for revenues, relies on continuous monitoring of KPI (Key Performance Indicators) and effective management, including accountability for the department. It isn’t easy to accurately comprehend and monitor the revenue cycle KPI without constantly updated reporting and benchmarking outlining current performance levels. For instance, if a company’s objective is to cut down on the number of days that accounts receivable is open by 10% over the next year, it must have a dashboard or scorecard that displays the days that are currently in accounts receivable and previous values to evaluate whether your current efforts are working.

Common key Performance Indicators for Revenue Cycle Indicators are

- Access to Patients Point of Service Collections to net revenue from patient services and insurance verification rate

- Pre-Billing & Claims Discharged not final invoiced (DNFB) days Not submitted to the payer (DNSP) day, the clean claim rate.

- Accounting Resolution: Net Days of accounts receivable (A/R) for insurance with a period of > 90 days since the date of discharge; insurance AR that is older than 180 days from the date of discharge and Denial Write-Offs in the form of a percentage of Net Patient Revenue

- Financial Management: Bad Debt as a percentage of net patient revenue; days with cash in hand and cash to net revenue (percent)

Wrapping Up

Revenue Cycle Management(RCM) is the foundation of any healthcare company, ensuring sustainable financial health in the long term. Implementing this method requires skilled personnel proficient in medical billing, code and other RCM tasks. If you don’t have such a skilled workforce, consider outsourcing the RCM and medical billing processes. Collaborating with your current Staff, MHRCM can help you implement an effective RCM strategy that ultimately helps increase reimbursements.

For more information regarding our revenue cycle support call us at info@mhrcm.com

Related Resource :

About the Author