Accounts Receivable determines the cash flow and financial stability of a business. Could anyone disagree with this statement? Literally, no one can have differences of opinion on this matter. A clear understanding of Accounts Receivable is essential for businesspeople to grow their businesses without facing financial instability or loss.

This blog will explore various types of Accounts Receivable and provide more mastery for businesses to handle and manage their AR effectively and efficiently.

Let’s dive deep into the kinds of Accounts Receivable and come up with a successful AR strategy together.

What is Accounts Receivable?

When a customer utilizes your service or buys your product without paying the estimated amount, that due amount is known as Accounts Receivable. There is a limitation on this outstanding amount, as businesses expect them to repay it within a particular period, like 30, 60, or 90 days. Accounts Receivable refers to the money that a business expects to get in the future. However, an effective Accounts Receivable Management process and strategy are essential for businesses to get paid earlier without delay.

The Role of Accounts Receivable

Here are three major roles of Accounts Receivable:

1. Cash flow management

Accounts Receivables can directly influence the cash flow of any business. Therefore, prompt collection of due payments ensures the cash flow and financial stability of businesses or medical clinics.

2. Risk management

Risk management is ensuring your clients or customers’ creditworthiness and then deciding on extending their credit time. This will help businesses to efficiently reduce the risk of bad debts and forthcoming financial losses.

3. Financial analysis

Monitoring the aging of receivables can help businesses to identify the latest trends, potential issues, and broaden the opportunities for improvement in its credit and collection policies.

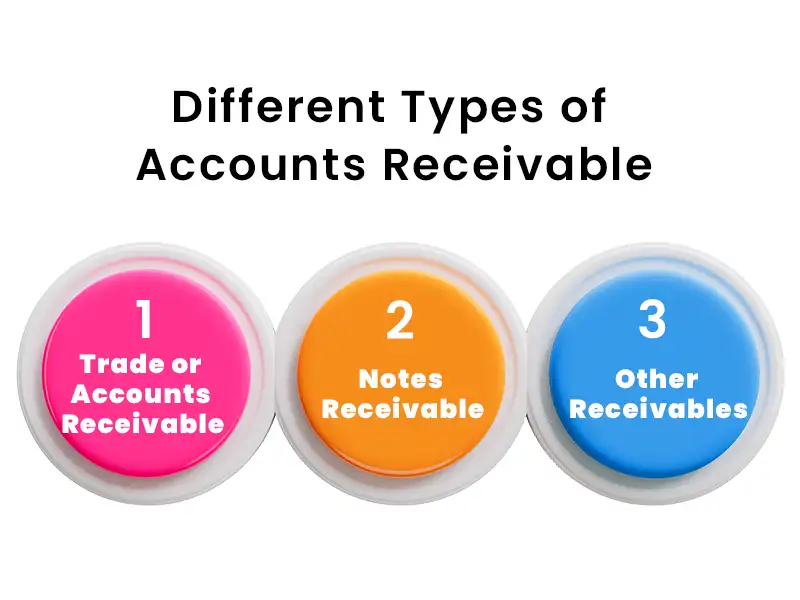

Different Types of Accounts Receivable

There are three major kinds of Accounts Receivable. They are:

1.Trade or Accounts Receivable

Accounts Receivable refers to the outstanding or due money that a client or customer owes to the business for the service or product provided. These outstanding amounts will be listed as assets on the balance sheets, and businesses should collect them within a particular period to maintain their cash flow. It is like a short-term loan offered to clients or customers.

Managing Accounts Receivable includes various processes. Here are some of them:

- Invoicing

- Monitoring receivables aging

- Following up on overdue payments

- Implementing credit policies

It will be difficult for businesses to collect the outstanding payment if it gets more and more delayed, so it is advisable to be prompt in collecting the outstanding payment once it crosses the predetermined limit.

2. Notes Receivable

In Accounts Receivable, it is not possible for businesses to extend the deadlines. However, Notes Receivable allow businesses to extend the due date as per a client or customer request.

In the note-receivable process, companies or businesses can allow their clients or customers to pay the overdue amount even after a year or two. In balance sheets, the Notes Receivable can be mentioned in two ways: current and long-term. The outstanding payment that will be paid within a year comes under current, and more than a year will be noted as long-term on the balance sheets.

3. Other Receivables

Other receivables refer to several types of non-trade receivables, such as salary receivables, interest receivables, employee advances, loans offered to employees or other companies, tax funds, and so on. These other receivables are outstanding payments that did not fall under the typical sales transactions.

Analyzing and monitoring a company’s other receivables is essential to understanding its various financial relationships.

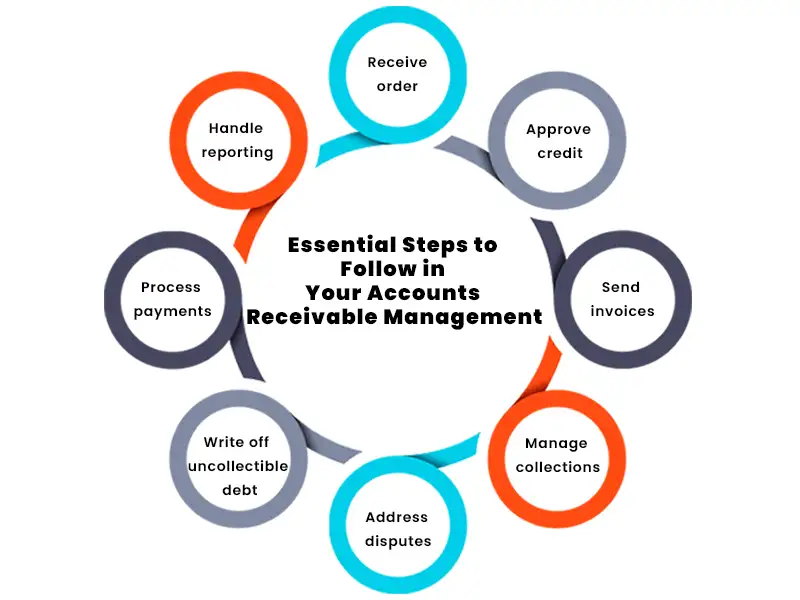

Essential Steps to Follow in Your Accounts Receivable Management

Take a quick look at eight important steps that every business should follow in their Accounts Receivable Management:

1. Receive order

Receiving orders is the first step in the Accounts Receivable Management process. In this stage, you should send your customer a Purchase Order (PO) as a declaration of the customer’s intent to buy your products or services.

Following the PO’s approval, a sales order will be sent to the customer with several details, ranging from quantity and price to discounts and delivery dates.

2. Approve credit

You should analyze the creditworthiness of your customer to minimize the bad debt rate. You should begin the assessment process by analyzing whether the customer has a past purchase history with your company or is a new client. You can deny or approve the credit at the end of this stage.

3. Send invoices

After confirming the creditworthiness of your customer, you can send an invoice with details such as due amount, due date, late payment fees, discounts, and so on. Mostly, invoices will be shared to customers through email.

4. Manage collections

You should efficiently manage your collection process. If you find a customer’s delay in paying the overdue amount, check that invoice, and once you ensure it is error-free, you should follow up with the customer for a quicker payment.

5. Address disputes

The issue with the service or product provided, variations between the actual proposal and the invoice sent, and communication barriers can result in the short payment of your customers. This will be an added task for your AR team.

6. Write off uncollectible debt

After every attempt at outreach has been made, payment can be deemed uncollectible.

7. Process payments

For accurate financial records and efficient payment processing, it is crucial to choose payment methods that are customer-friendly. It will be better to use online payment methods, as it can increase the chances of quicker payment.

8. Handle reporting

At the end of every month, the finance team will review all the transactions. The closing balance of all the general ledgers accounts will be transferred into a trial balance sheet.

By understanding all the kinds of Accounts Receivable and following the essential A/R Management steps in your business or medical clinic, you can surely witness increased cash flow and enhanced financial stability.

To make your A/R collection process even easier, the MHRCM Accounts Receivable Management team is here to take over your complete A/R process. Outsource to MHRCM now to increase your clinic’s cash flow.

Frequently Asked Questions

What is Accounts Receivable?

When a customer utilizes your service or buys your product without paying the estimated amount, that due amount is known as Accounts Receivable.

How can MHRCM Experts Enhance my Healthcare Clinic’s A/R Collection?

Our experts follow the below mentioned steps to manage your A/R collection process:

Using online payments

Using right KPIs

Specifying precise billing methods

Setting clear collection policies

Setting up automations

Is Outsourcing A/R Collection a Good Idea?

Yes, outsourcing your A/R collection process to an expert RCM agency like MHRCM is a good idea.

Related Resource

About the Author