The insurance Verification process with automated tools, accurate reporting, and human support to understand the coverage limits and the renewal details will help any dental care system retain their patients and increase the revenue. The patient support system relies on Insurance verification as most patients don’t have the time to read and update themselves with their outsource dental insurance. In addition, patients rely on the dental care staff for verification and other coverage details. Unless the dentist’s office has efficient, automated, and reliable revenue cycle management software, it’s hard to generate revenue.

Challenges in Insurance Verification Process:

Taking care of the insurance verification process is not that easy for your billing department or front-office staff. So instead, Outsource the dental verification process to a trusted RCM (Revenue Cycle Management) company like MHRCM.

Time Savings: Automating the insurance verification process will save you valuable time that can be spent on patient care.

Reduced Errors: Manual data entry can lead to costly mistakes. Our automated system process helps eliminate errors, ensuring accurate insurance information for each patient.

Improved Efficiency: With quick access to insurance coverage details, your front office staff can streamline the check-in process and reduce wait times for patients.

Faster Check-In: Patients will appreciate a faster check-in process thanks to our automated outsourcing dental insurance verification system.

Accurate Billing: By ensuring accurate insurance information upfront, patients are less likely to face unexpected costs or billing issues after their visit.

Enhanced Experience: The check-in process sets the tone for the entire patient visit, resulting in greater satisfaction and loyalty.

Why Choose MHRCM for Dental Insurances?

Save Thousands: We verify the patient’s insurance upfront and inform the payment details and the pitfall between the policy coverage and treatment cost. Patients will feel tricked when asked for additional payments after the treatment or during claiming. MHRCM has the right technology to process bills with 100% accuracy, save thousands, and generate more revenue each year.

Simplified Accounts Receivable Management: Ensuring accurate insurance details in the patient’s treatment file helps patients plan their medical bills and pay without hesitation.

Patient Satisfaction System: Your business’s profit lies in the customers’ happiness. Customer happiness is reflected in increased patient referrals, profitable practice, and decreased no-show appointments.

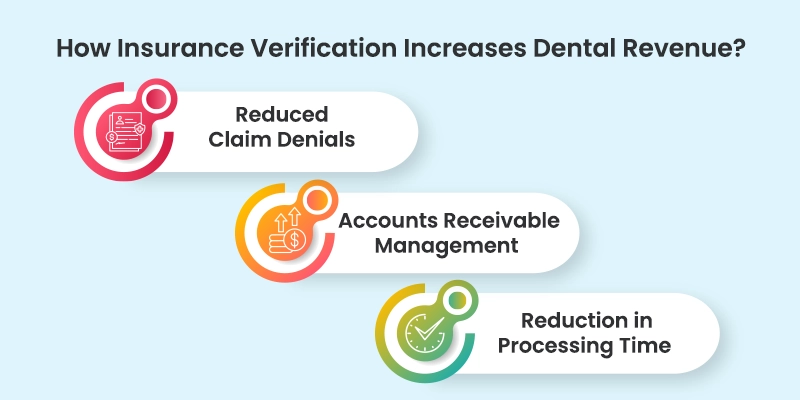

How Insurance Verification Increases Dental Revenue?

In addition to creating accurate patient billing, insurance verification reduces the chance of a surprise patient statement, leading to frustrating phone calls, bad online reviews, and low patient retention. Verifying a patient’s insurance benefits is critical to developing strong relationships with patients and increasing case acceptance rates. Patients are also more likely to pay their copayments if they are confident that their coverage will cover their visit.

In the current healthcare environment, dentists and other providers need to ensure that all patients have the right insurance coverage; otherwise, claim denials will increase. Insurance eligibility verification helps reduce denials and minimizes write-offs. It is also an excellent way to engage patients on financial matters and increase their chances of receiving payment.

Insurance verification services are an essential first step in maximizing revenue capture and minimizing claims denials. Verifying patient insurance is the starting point for AR (Accounts Receivable) management. It is the first step in ensuring that your patient’s insurance is valid and allows you to charge them accordingly. In addition, insurance verification is a valuable tool for reducing the number of denials, which can be costly for the dentist and the patient.

Accounts Receivable Management:

First, dental insurance verification involves verifying the insurance coverage of each patient. Dental insurance benefits differ greatly by plan, and it is important to be familiar with each. The more accurate insurance coverage clinics have, the more likely patients will accept the treatment plan. It also helps clinics avoid any unexpected payments or copayments. In addition, it helps dentists avoid mistakes when processing dental insurance claims and ensures an accurate and well-organized treatment plan.

Reduction in Processing Time:

Automated eligibility verification systems can automate the process, reducing the amount of paperwork required. They can automatically run coverage, and remaining benefits checks up to a week before a patient’s appointment. Unlike manual eligibility checks, automated eligibility verification solutions can also deliver comprehensive results in real-time, including the payer, provider, type of coverage, deductibles and maximums, and the patient’s financial responsibility.

The Importance of Insurance Verification for Dental Process:

Dental insurance verification is a crucial step in ensuring payment for services provided by a dentist. By confirming patient insurance details, dentists can streamline the dental process and avoid the need for repeated calls to insurance companies. Insurance verification services can also help dental offices educate patients about their insurance coverage so they can discuss payment options with patients. In addition, by verifying insurance information before dental procedures, dentists can ensure payment for procedures such as scaling and root planning and avoid receiving less than expected from insurance companies.

Benefits of Hiring a Dental Insurance Verification Service:

Collection of Patient Insurance Information:

You should collect patient insurance information at the intake for your dental process. It will help you ensure you are following HIPAA regulations and avoid confusion. You can do this with a simple email widget that passes on basic information about the patient. You can also include a form allowing patients to authorize the processing of their personal health information.

Identifying Issues with a Patient’s Coverage:

Identifying issues with patients’ coverage for your dental process can be difficult, particularly because the regulatory and statutory language is not always clear and consistent. Yet, one carrier seems to have endorsed the coverage of oral examinations for patients undergoing kidney, heart, or liver transplants. This policy also allows these procedures to be done on an outpatient basis. In the absence of a specific policy, it is important to determine whether a patient has coverage for the entire process before attempting to bill insurance for any services.

When it comes to preventing denial of payment, insurance verification is essential. There are many options available to verify your insurance. There are three options to verify your insurance: fax, automated services, or in-house.