Secure your Healthcare Finances with our best Revenue Cycle Management solutions. It helps to monitor and collect patient revenue. RCM process starts by scheduling a patient through the final payment for healthcare services. By utilizing the Revenue Cycle Management best practices, you can ensure the maximum repayment services. In this blog, MHRCM provides you with top Revenue Cycle Management solutions for efficiency.

Spot Patients and Their Preferences

Make sure that your patients are involved in the payment process and updated with the information. Providers must maintain a transparent relationship with patients to sustain long-term success and loyalty. Give a clear idea of various payment options and what to expect from billing. Explain clearly about the several choices of payment and billing expectations. With this, there is less possibility of patients to be taken back by medical bills. This helps torc manage their responsibilities.

Instead of waiting till the patient’s appointment to discuss the payment options, collect payment details during the appointment booking process. This information includes recording the insurance details, credit card details, or services not covered by insurance plans.

Streamline Claim Authorization

Engage an automated system to simplify the claim authorization process. This approach will save important time by streamlining the submission of claims. Patients will be informed whether the service is covered or not.

Enhance Claim Filing Speed

Despite the insurance claims filed promptly, the process takes up to 30 days. To minimize the payment details, categorize claim submission after the patient has received the service. This ensures that filing deadlines are met and payments are received on schedule.

Effective Claim Denials Management

Errors such as incorrect coding, missing information and duplicate claims can be prevented through streamlined claim process. You need to track claim denials to identify consistent patterns and collaborate with your team to address the issues before filing. Certain tips for an efficient Denial Management Process are discussed below.

Ensure Claim Forms are Filled Completely:

Provide accurate and complete information in claim forms to increase the chance of Medical Claim being approved. In order to provide accurate information, it is necessary to validate the insurance policy of the patient and understand what is covered and what is not. You must ensure the patient’s details such as Name, Address, and Policy number are updated. Include all documentation such as lab results, radiology reports and referral reports. Make sure that you sign and date the form before submitting it to the insurance company. Once the claim form is submitted, follow up with the insurance company to ensure that the claim has been processed correctly.

Always Look for Prior Authorization:

Ensure Medical Billing Accuracy:

Documenting all the patient information and procedures within the specified time helps to make your billing accurate. Capturing the billing information consistently and automating billing increases efficiency and minimizes errors. Regular Training can be conducted to make sure that the process is understood clearly by billers, and they can complete the tasks.

Monitor Accounts Receivable Balances

The Accounts Receivable Management team utilizes various types of reports to track customer accounts and payments. Customer Reports can be categorized as:

This report provides customer details such as credit limits, payment information, currency preference and more.

This Report divides customers by the revenue amount they generate. You can also identify your top customers.

Customer Transaction Report:

This transaction report provides an overview of customer interactions within the specified time. You can also see customer accounts that possess overdue receivables, unapplied cash and others.

Customer Credit Reports provide detailed customer insights. The credit reports are generated from automatic solutions. These reports help AR Managers to make the right decisions.

Transaction and Payment Reports:

These reports include error reports, batch listings, etc. Transaction Reports are important for auditing. Payment Reports show payment details such as paid invoices, payment dates, and payment methods for each customer.

Accept Technological Investments:

Even though your Revenue Cycle management is functioning well, focus more on enhancing your performance to maximize the cash flow and revenue. Improved performance saves time by decreasing denials and reducing costs.

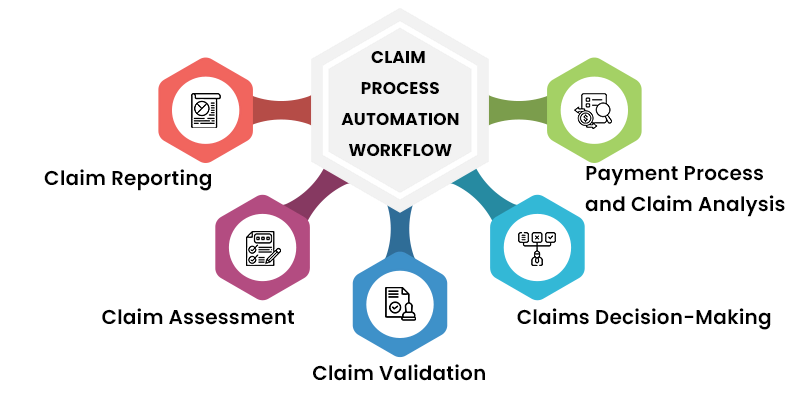

The process is initiated when a policy holder reports a claim to the insurer. This can be done mostly through mobile apps or online portals. The policy holder provides details about the claim such as date, location of the incident and any support documentation.

After the claim is reported, the insurer uses automated tools for analyzing and ensures whether the claim is covered by policy. This assessment involves analyzing and reviewing the issues.

Once the claim is considered valid, the insurer will validate the claim by collecting additional details such as medical records and report calculations. This process can be automated by using AI algorithms to assess the claim validity.

Based on the details collected during the assessment and validation stages, the insurer will decide about the claim.

Payment Process and Claim Analysis

Once the claim is approved, the insurer hewill initiate payment to the claim. This involves automating the payment process through funds transfer or other payment methods.

There are several best practices that simplify the overall Revenue Cycle Management process. The are given below.

Your company must have effective contracts with the insurance company and make sure you won’t lose money to the payer.

With increased insurance plans, patients are more responsible for the bill. You may analyze the patient’s portion before the service. As soon as a request is made, it is necessary to perform authorization service before the service. Medical providers must automate authorization requests. This saves the staff time and enables patients to understand quickly about the insurance coverage. You need to have a clear engagement with the patient about the cost of the service.