In the fast-paced, ever-evolving healthcare landscape, striking a balance between financial stability and patient-centric care can feel like walking a tightrope. But fear not, for the unsung hero of this balancing act is none other than Accounts Receivable (AR). More than just a technical term, AR collections are the heartbeat of your healthcare organization’s financial health, directly impacting patient satisfaction and your ability to deliver exceptional care.

This blog delves into the necessity of Medical AR collections and how mastering this crucial aspect of Revenue Cycle Management (RCM) can empower your organization to:

Why is Accounts Receivable Essential in Healthcare?

Accounts Receivable is a term used to describe the remaining amount of money that patients and insurance companies pay a healthcare facility for services provided. It’s the invoice that still hasn’t been paid. AR is a measure of the financial health of the organization for healthcare providers. The first stage to enhance financial results is to understand all aspects of AR, from its elements to its life cycle. In the medical field, AR is important for things like predictable cash flow, patient happiness, and the smooth running of medical facilities.

Ways to Reduce on Accounts Receivable Days

Accurately Performing the First Time

It is imperative that healthcare professionals appropriately gather patient data and accurately file claims on their initial try. Errors and inaccuracies predispose providers to deny insurance claims and extended AR cycles from the outset. One of the primary things an analyst looks at is the Accounts Receivable turnover ratio, or the number of times a business has collected from its Accounts Receivable.

The largest risk to the payment of medical claims is unverified insurance. From the standpoint of the revenue cycle, patient scheduling and registration are the first steps in obtaining the most correct information up front.

Establish Payment Terms and Quickly Gather Patient Portions

Providers can reduce their number of payments that are late from patients by providing patients with advance notice of payment terms or expectations on their financial responsibilities before scheduled visits. In addition, if medical professionals don’t intentionally try to collect patient copays prior to patients leaving treatment facilities, they may end up losing money. Reimbursement to providers is 20% lower when patients miss appointments and take longer to pay.

Receiving payment from patients right away facilitates tracking efforts later in the AR collections for financial health and helps close one part of the cycle more swiftly. Incorporate timely customer invoice collection into discharge procedures; hospitals write off over half of all patients’ financial obligations as bad debt.

To get paid after charging patients and payors, providers must first capture and code charges. Longer adverse response durations and claim denial are the results of charge entry errors and erroneous patient data on submitted claims. Resubmitting claims not only shortens the time gap between treatment and payment, but it also raises staff costs.

By monitoring your Healthcare Accounts Receivable Management monthly, providers can obtain the data they need to identify those that could leak money or contribute to bad debt. By comparing ARs over time, providers can identify potentially harmful trends early on and identify any overdue reimbursements that might be simple to settle. Tracking Accounts Receivable (AR) is a wonderful method to use a balance sheet to record outstanding invoices, customer payments, and AR.

Reports on Accounts Receivable should be done by providers to ascertain their average AR cycles.

Is there a lag in billing after care is rendered? As lengthier ARs have a greater chance of being forgotten by patients and resulting in unpaid invoices, it is best to start the cycle as soon as possible to prevent the debt from accumulating past collection age. The length of time that each stage of the Medical AR cycle takes can be used by providers to see where improvements might be made.

RCM firms can use their experience and big data analytics to identify the areas in which providers face the most difficulties with AR. Many of the potential for administrative errors in revenue and Accounts Receivable cycles are quick. Addressed by integrations with your electronic health records to capture all charges, assure code accuracy, and automatically resubmit denied claims.

Get in touch with us right now to collaborate with our group of committed AR and RCM experts and preserve the financial stability of your business.

What Makes Financial Management Crucial for Any Kind of Business?

Because it enables businesses to have sufficient cash flow to continue operating. This implies that any decline in sales or an economic downturn could be devastating.

Poor cash management can cause businesses to fall behind in their monthly operating costs and debt. Payroll processing may be delayed by a shortage of cash flow during difficult situations. Your company has little chance of recovering if your cash flow problems reach that stage.

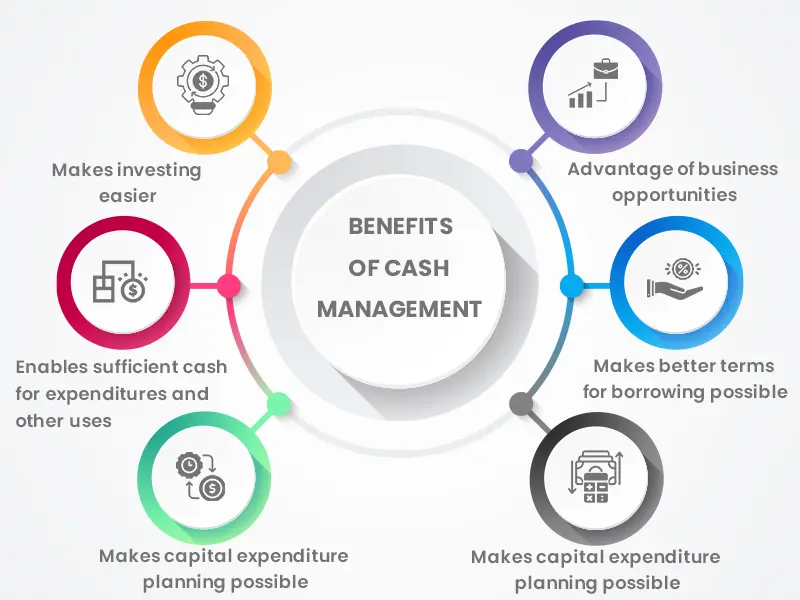

Benefits of Cash Management Include:

Managing Financial Strength

This is crucial for Cash Flow Management. Making sensible investment choices enables funds to be on hand for emergencies. Making sure you pay your suppliers on time also helps to maintain the cash flow of your suppliers and stops them from raising the pricing of essential goods. You can guarantee that the economy functions more smoothly for everyone by practicing good Cash Flow Management.

The Objectives of Financial Management for Your Company

Reducing or doing away with surprises while meeting financial obligations is the main objective of effective cash management systems. Effective cash management lowers operating expenses overall and improves operational efficiency.

Outsource Revenue Cycle Management Solutions

Healthcare companies must understand Accounts Receivable in order to maintain their financial stability and assure timely payment. Accounts Receivable Management is a multifaceted process that includes invoicing, submitting claims, following up, and patient collections. Healthcare providers can enhance their overall financial performance and optimize their revenue cycle through implementing effective solutions. Healthcare businesses may continue to operate and offer high-quality patient care when their Accounts Receivable process is well-managed. To start improving your financial situation, MHRCM helps to examine your current situation honestly.